Exploring the Crucial Duty of Financial Obligation Management Plans in Structure a Solid Structure for Your Financial Future

In today's intricate financial landscape, the sensible administration of financial obligation is a cornerstone of safeguarding a flourishing and secure future. Debt monitoring strategies (DMPs) work as calculated tools that can considerably influence one's monetary well-being (debt management plan singapore). By meticulously structuring settlement timetables, discussing with creditors, and fostering a regimented approach to financial responsibilities, DMPs supply a pathway towards achieving financial security. Nevertheless, real worth of these strategies surpasses mere debt reduction; they prepared for a strong structure whereupon individuals can develop an extra protected and lasting financial future. By checking out the intricacies of DMPs and understanding their critical duty, people can take aggressive actions in the direction of obtaining control over their finances and functioning in the direction of long-term prosperity.

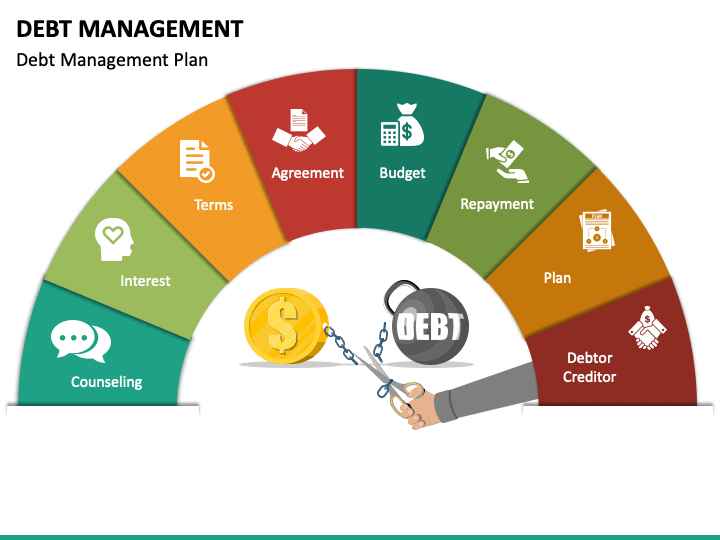

Relevance of Financial Debt Management Plans

Making use of an organized financial obligation administration strategy is critical for people seeking to regain control of their finances and lead the means towards a safe and secure and steady financial future. By implementing a well-balanced financial obligation management plan, people can systematically address their superior financial debts, prioritize repayments, and inevitably work in the direction of ending up being debt-free.

One of the crucial benefits of a debt administration plan is that it supplies a clear roadmap for managing financial debts effectively. Rather than really feeling overwhelmed by numerous financial debts and differing rate of interest, a structured strategy enables individuals to settle their financial obligations, negotiate with financial institutions, and develop a possible repayment schedule. debt management plan singapore. This well organized technique not just simplifies the financial debt repayment procedure however also aids people track their progression towards financial liberty

Benefits of Implementing a DMP

Carrying Out a Financial Debt Administration Plan (DMP) uses individuals a strategic approach to efficiently tackle their financial debts and lead the method towards financial security and freedom. Among the vital benefits of a DMP is the loan consolidation of numerous financial obligations into a solitary monthly settlement, simplifying economic administration and reducing the threat of missed settlements. By dealing with a credit therapy agency to discuss lower rates of interest or forgo particular charges, individuals under a DMP can potentially conserve money in the lengthy run. Furthermore, DMPs frequently feature a structured settlement plan that is customized to the individual's economic situation, making it extra sustainable and convenient. One more benefit is the prospective improvement in credit report ratings as individuals constantly make on-time settlements via the DMP. This can open up possibilities for much better rate of interest on future fundings or bank card. Overall, executing a DMP can provide people with a clear course towards ending up being debt-free and accomplishing better financial protection.

Steps to Developing an Effective DMP

With a clear understanding of the benefits of a Debt Administration Plan (DMP), the initial step in the direction of economic stability Your Domain Name includes laying out the necessary actions to produce an effective DMP strategy. The primary step is to evaluate your economic situation completely. This consists of listing all your financial obligations, their rates of interest, and any type of various other relevant economic responsibilities. Next, develop a practical spending plan that covers your required expenses while designating funds towards settling your debts. As soon as you have a clear introduction of your finances, get to out to a reliable credit report counseling company to help you establish a customized DMP. The agency will certainly negotiate with your financial institutions to possibly lower rate of interest or forgo fees. Furthermore, they will certainly consolidate your settlements into one regular monthly amount, making it less complicated to manage. Keep dedicated to your DMP by making prompt payments and routinely assessing your budget to ensure you remain on track. Finally, celebrate tiny triumphes along the road as you advance in the direction of a debt-free future.

Effect of DMPs on Financial Stability

Embarking on a Debt Management Strategy (DMP) can dramatically enhance one's economic security by methodically restructuring debt repayment strategies. By consolidating debts into a single monthly settlement and negotiating possibly lower interest prices with financial institutions, people can gain back control over their monetary situation. This structured strategy not just streamlines the payment process yet additionally helps in staying clear of missed settlements and late charges, thus protecting against an additional accumulation of financial obligation.

One of the vital benefits of DMPs is the potential enhancement in credit report. As people constantly make on-time payments through the strategy, their credit reliability might increase with time. This can open chances for far better rates of interest on future finances and credit report items, eventually adding to a much healthier monetary outlook. In general, DMPs play a vital role in not only fixing existing debt issues however likewise in laying a solid structure for a much more secure economic future.

Long-Term Techniques for DMP Success

For sustained effectiveness in Financial debt Administration Plans (DMPs), taking on long-lasting financial habits is essential. While DMPs give an organized method to settle financial debts, incorporating long lasting approaches into your monetary behavior can improve the success of the strategy.

Another crucial facet of long-term DMP success is to prioritize financial debt repayment. By concentrating on removing high-interest financial debts initially or using windfalls like bonuses or tax reimbursements in the direction of debt reduction, you can speed up the settlement procedure. Moreover, cultivating her explanation healthy monetary behaviors such as avoiding unnecessary costs, bargaining lower rate of interest with lenders, and seeking extra resources of revenue can better bolster the effectiveness of your DMP in the long run. By incorporating these methods right into your economic regimen, you can lead the way for a much more steady and debt-free future.

Conclusion

In final thought, financial debt management plans play a crucial role in establishing a strong economic structure for individuals. By executing a DMP, individuals can gain from lowered rate of interest, simplified payment timetables, and click reference enhanced monetary stability. Complying with the actions to create a successful DMP and implementing long-lasting methods can result in durable positive effects on one's economic wellness. It is necessary to prioritize financial debt administration and take proactive actions towards economic protection.

One of the vital advantages of a debt administration plan is that it supplies a clear roadmap for managing financial obligations successfully. Rather than really feeling bewildered by multiple financial debts and varying rate of interest prices, a structured plan permits people to combine their financial debts, negotiate with lenders, and develop a feasible payment timetable.Implementing a Financial Obligation Monitoring Plan (DMP) uses people a strategic method to efficiently tackle their financial obligations and lead the way towards economic stability and liberty.Embarking on a Financial Obligation Monitoring Plan (DMP) can substantially boost one's financial stability by methodically restructuring financial debt repayment techniques. By concentrating on clearing high-interest financial obligations initially or making use of windfalls like bonus offers or tax obligation refunds towards debt reduction, you can speed up the settlement process.